This article was featured on MedTech Dive

Access to orthopaedic surgical care has radically transformed over the past five years. Surgeries that were traditionally done in inpatient, hospital-based settings have steadily migrated to outpatient Ambulatory Surgery Centers (ASCs). This shift offers patients access to more convenient, efficient, and high-quality care. AcuityMD has been closely following the trend of surgeries shifting away from hospital-based settings into freestanding ASCs.

Total Knee Arthroplasty (TKA) and Total Hip Arthroplasty (THA) surgeries are some of the most widely performed orthopaedic surgeries and can be used as a barometer to track the overall shift in procedures towards ASCs.

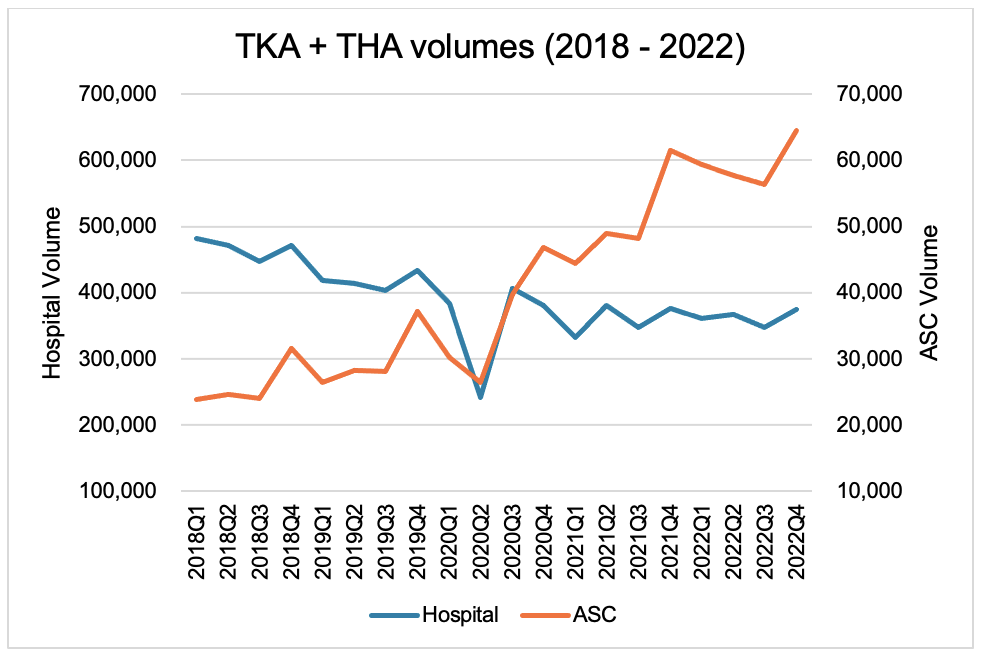

Since Q1 2018, TKA and THA procedures done at hospitals have decreased by 1.3% per quarter, whereas ASC volumes have steadily increased by 5.4% per quarter. ASCs now perform over 15% of TKA and THA surgeries in the USA.

Changes to the reimbursement landscape and permanent shifts following COVID-19 have each provided tailwinds for this shift. The Centers for Medicare & Medicaid Services (CMS) added TKA to its covered procedure list for ASCs in 2019, with THA following in 2021. COVID-19 accelerated this shift towards ASCs. In Q2 2020, TKA and THA total volumes dipped almost 40% from the prior year, as surgeries were cancelled or postponed across the country. Since that low point, these ASC surgical volumes have steadily increased by >9% per quarter. In contrast, hospitals have yet to recover to their pre-pandemic volumes.

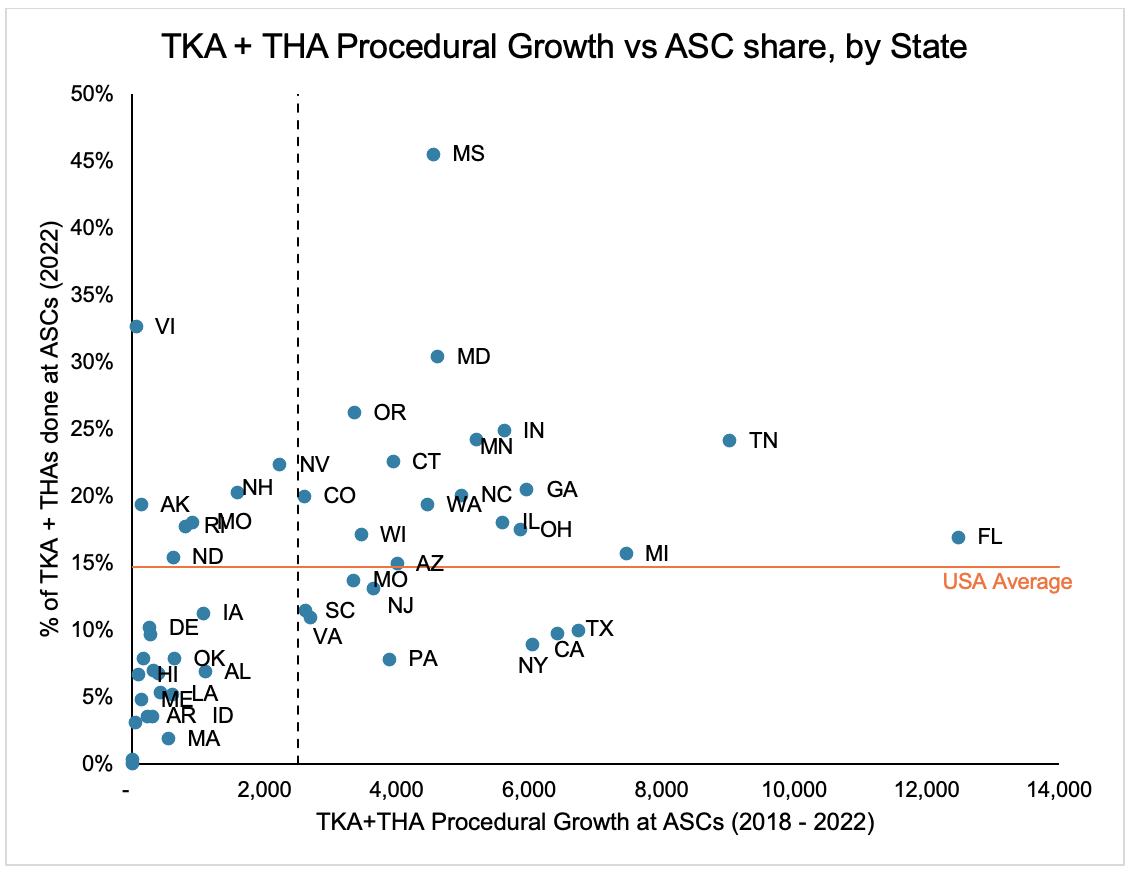

However, the shift to ASCs has not been consistent across the USA. The ASC landscape in states like Mississippi, Ohio, Tennessee, and Florida are among the more mature in the country: these states have seen significant increases in ASC volume and are above the national average of ASC procedural penetration. Larger states like Texas, California, Pennsylvania, and New York have seen recent increases in ASC volumes but are still well below the US average, demonstrating potential additional capacity for orthopaedic ASCs.

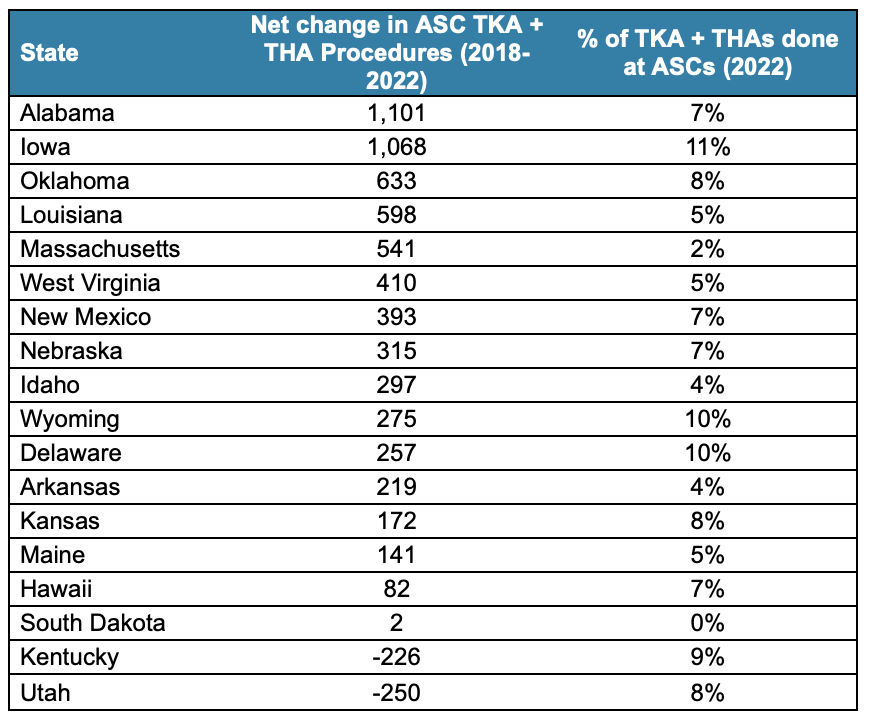

In contrast, the states in the bottom left quadrant have not had as robust ASC growth and are still well below the national average of ASC penetration. In these states, the orthopaedic ASCs are in the earlier stages of market maturity and penetration. These disparities demonstrate an opportunity for new orthopaedic ASCs to open and provide convenient and high-quality care for patients. There could be several drivers of geographic divergence, including regional hospital referral networks, orthopaedic practice affiliations, overall health of patient populations, and state-level regulations and licensing requirements. For better visibility, these states are listed below:

The orthopaedic ASC market has rapidly matured over the last five years, due to reimbursement tailwinds and the impact of COVID-19. However, given the large geographic variations, patients across the country still have unequal access to ASC-based care.

To accelerate access to orthopaedic medical technology, parties should look to establish ASCs in underserved areas where there is significant procedure volume still performed at hospital settings, especially in geographics where the cost to establish ASCs is reasonable. Surgeons interested in either founding an ASC or working at an ASC can see where these geographic trends are and adapt their practice accordingly. MedTech companies can also use this information to better plan for increased inventory needs at ASCs and improve their go-to-market strategy.

Going forward, AcuityMD expects ASCs to continue gaining popularity across the USA. Medical technology and medical device suppliers selling into ASCs must remain nimble to the rapidly evolving market as surgeries continue to shift to outpatient and ASC settings.

To learn more about ASC market trends, including the metropolitan areas poised for ASC growth, contact AcuityMD here.