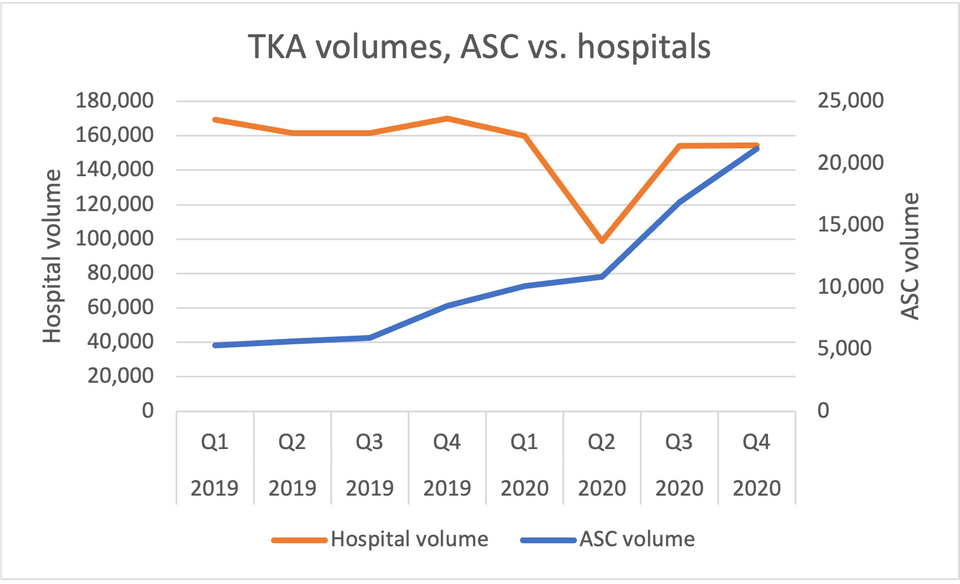

While the overall volume of patients treated at ASCs followed a similar trajectory, some Orthopaedic surgeries such as knee replacements defied this trend entirely.

ASCs continued to see a rise in knee replacement surgeries throughout the pandemic.

The postponement of elective surgeries due to the pandemic and patients' desire to avoid hospitals during COVID-19 surges likely contributed to this accelerating migration to ASCs. Overall, routine screenings (e.g., colonoscopies) decreased at a greater rate than high-priority elective surgeries like knee replacements.

Despite COVID-19, ASC-based orthopaedic surgeries have continued to grow rapidly

Orthopaedic procedures recently approved for Medicare coverage in ASC settings (e.g., total knee and total hip arthroplasties) have continued on their path of pre-pandemic growth. Though hospitals saw a significant drop-off in knee replacement volume in 2020 Q2, ASCs fared far better than hospitals, steadily increasing their number of knee replacements done.

Total knee arthroplasty volume rose slightly in ASCs in 2020 from Q1 to Q2 then continued to grow to new all-time highs in Q3 and Q4, more than doubling procedure volume year-over-year. Meanwhile, hospital volume for the same procedure dropped dramatically in Q2 and fell short of pre-pandemic levels in Q3.

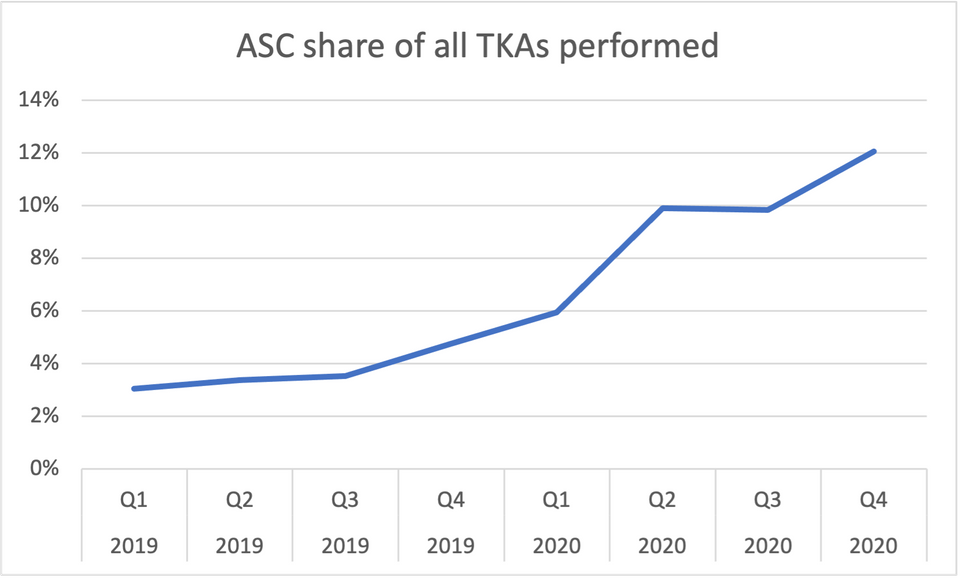

ASCs take on a growing share of all knee replacements

Even before the pandemic, ASCs were beginning to capture a greater share of the knee replacement market. COVID-19 has accelerated this migration towards ASCs as knee replacements continue to grow in this setting while hospitals' volume still lags behind pre-pandemic levels. Due to Medicare's recent decision to reimburse ASC-based knee replacements, ASCs will likely enjoy robust growth in patient volume in the coming years.

ASCs performed over 12% of all knee replacements in 2020 Q4, quadrupling its share of the market since the beginning of 2019

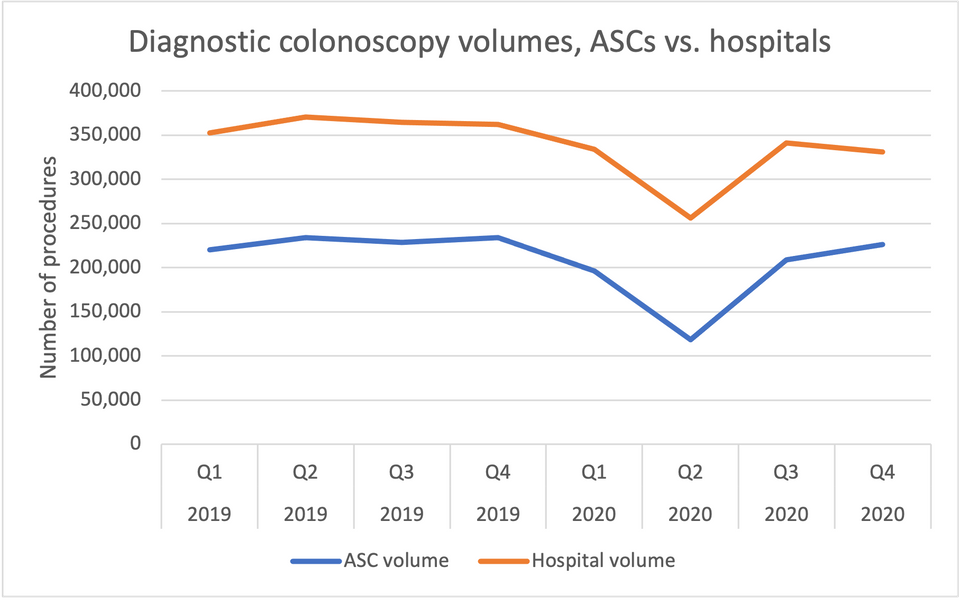

Colonoscopy volumes declined through COVID, especially in ASCs

In contrast to Orthopaedic surgeries, routine and diagnostic procedures like colonoscopies saw greater reductions in volume across Hospital and ASC-based settings. Healthier patients scheduled for a colonoscopy as part of an annual physical were more likely to forgo care than higher-acuity patients undergoing surgeries such as knee replacements.

ASCs, in a reversal of how they fared with regards to knee replacement volume, saw a steeper proportional decline in all colonoscopy procedures than did hospitals. One factor driving this trend is that patients who choose to undergo a colonoscopy in an ASC setting are generally younger and healthier than those who do so in a hospital. During the first wave of the pandemic, healthier patients likely put off routine or non-urgent colonoscopies when possible while patients requiring hospital care (who may be older and have more health complications) were less likely to postpone care.

- From 2019 Q4 to 2020 Q2, hospital volume for diagnostic colonoscopies fell from 362K to 256K: a 30% decrease. ASC volume for the same procedure fell from 234K to 118K: a 50% decrease.

- Over the same period, colonoscopies with lesion removals fell in hospitals from 393K to 218K: a 44% decrease. ASC volume fell from 354K to 164K: a 54% decrease.

The next post in our ASC blog series will compare the safety, quality, and cost-of-care across several common procedures performed at ASCs and hospitals. Don't miss it!